Monitoring Implementation of Reforms

The FSB, through the Standing Committee on Standards Implementation (SCSI), coordinates and oversees the monitoring of the implementation of agreed financial reforms and its reporting to the G20. This includes reporting on members’ commitments and progress in implementing international financial standards and other policy initiatives; conducting peer reviews of FSB members (which are an obligation of membership); and encouraging global adherence to prudential regulatory and supervisory standards.

In 2025, at the request of the South African G20 Presidency, the FSB embarked on a strategic review of its work to encourage and monitor the implementation by member jurisdictions of the agreed G20/FSB financial reforms, with a view to identify any opportunities for improvement. A preliminary report was published in October 2025. The review is being conducted by a small group of Plenary members, led by former FSB Chair Randal Quarles.

The FSB implementation monitoring work is conducted within a Coordination Framework for Implementation Monitoring (CFIM) Coordination Framework for Implementation (CFIM), established in collaboration with the standard-setting bodies to strengthen the coordination and effectiveness of this monitoring. The CFIM was endorsed by the G20 Leaders at the Cannes Summit as a way to “intensify our monitoring of financial regulatory reforms, report on our progress and track our deficiencies”.

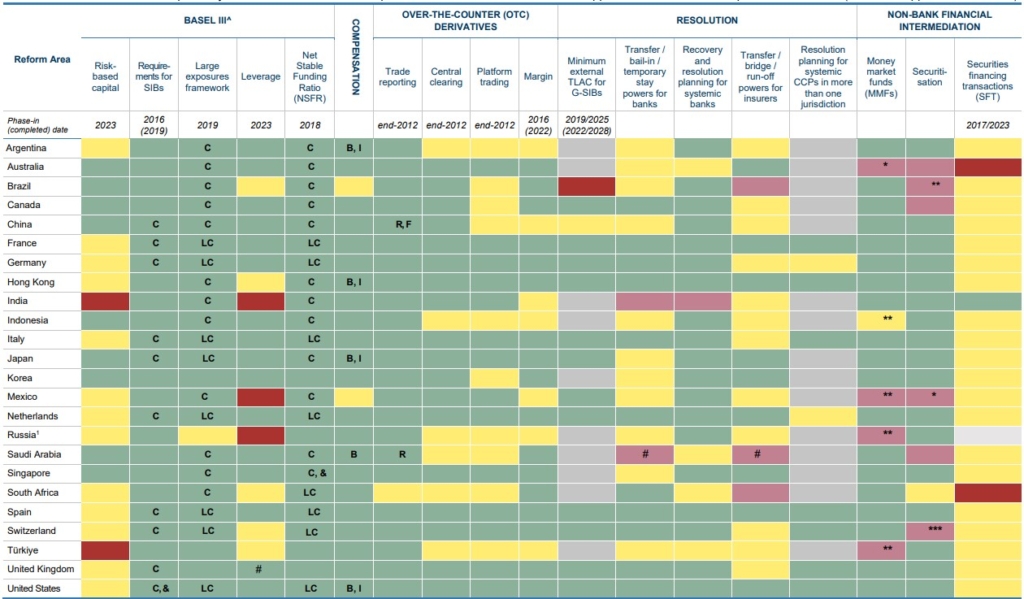

The CFIM distinguishes between priority areas, which undergo more intensive monitoring and detailed reporting via periodic progress reports and peer reviews, and other areas of reform. The current list of priority areas, reviewed annually by the FSB in light of policy developments at the international level, comprises:

- The Basel III framework

- Policy measures for global systemically important financial institutions

- Compensation practices

- Over-the-counter derivatives market reforms

- Resolution frameworks

- Non-bank financial intermediation

Effects of Reforms

With the main elements of the post-crisis reforms agreed and implementation underway, more detailed analysis of the effects of those reforms is becoming possible. The FSB, in collaboration with the SSBs, is analysing the effects of reforms, including whether the reforms are working together as intended. The main findings are summarised in the annual FSB reports on the implementation and effects of the G20 financial regulatory reforms.

In order to enhance the analysis of the effects of reforms, the FSB in collaboration with the SSBs published in July 2017 a framework for the post-implementation evaluation of the effects of the G20 financial regulatory reforms. The framework guides analyses of whether the reforms are achieving their intended outcomes, and helps identify any material unintended consequences that may have to be addressed, without compromising on the objectives of the reforms.

Annual Report on Implementation and Effects

In 2015, the FSB started to publish – and send to G20 Summits – annual reports on the implementation and effects of the G20 financial regulatory reforms. The reports highlighted the progress made by G20 and FSB members in implementing regulatory reforms to fix the fault lines that led to the global financial crisis and build a safer, more resilient financial system. With the FSB’s overall work shifting increasingly to new topics and the assessment of new and emerging risks, the report has been revamped to be more forward-looking and encompassing so that it describes the FSB’s work to promote global financial stability.

Latest report

Past reports

2023 Annual Report and Implementation Dashboard (October 2023)

2022 Annual Report and Implementation Dashboard (October 2022)

2021 Annual Report and Implementation Dashboard (October 2021)

2020 Annual Report and Implementation Dashboard (November 2020)

2019 Annual Report and Implementation Dashboard (October 2019)

2018 Annual Report and Implementation Dashboard (November 2018)

2017 Annual Report and Implementation Dashboard (July 2017)

2016 Annual Report and Implementation Dashboard (August 2016)

2015 Annual Report and Implementation Dashboard (November 2015)

Links on this page provide information on implementation progress for priority and other reform areas, G20 progress reports, FSB thematic and country peer reviews, the FSB’s work on the effects of reforms, and the FSB’s initiative on international cooperation and information exchange.