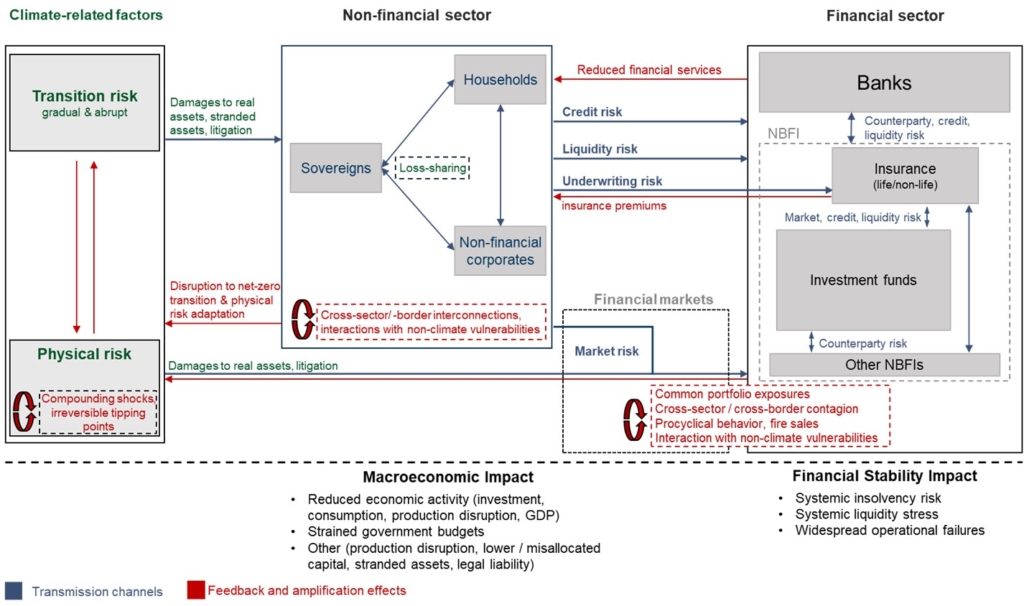

Climate-related shocks could materialise through abrupt changes in policies, technological innovation and/or consumer preferences (transition risks), or through the materialisation of physical hazards, such as floods, droughts or windstorms (physical risks). These shocks raise concerns over financial institutions’ ability to manage their risks and to continue to provide financial services in certain segments and geographical areas. Climate shocks can interact with existing vulnerabilities in the real economy or in the financial system and threaten financial stability through various transmission channels and amplification mechanisms.

This report introduces an analytical framework that the FSB will use to trace how physical and transition climate risks can be transmitted and amplified by the global financial system. This framework builds on the existing FSB Financial Stability Surveillance Framework and focuses on assessing climate-related vulnerabilities holistically, particularly from a cross-border and cross-sectoral point of view.

Complementing the framework, the report identifies various metrics used by FSB members that could potentially be used to monitor climate-related vulnerabilities from a forward-looking perspective. The framework and toolkit are live documents, to be refined as understanding evolves on how climate-related vulnerabilities affect financial stability and as methodological and data issues are resolved.