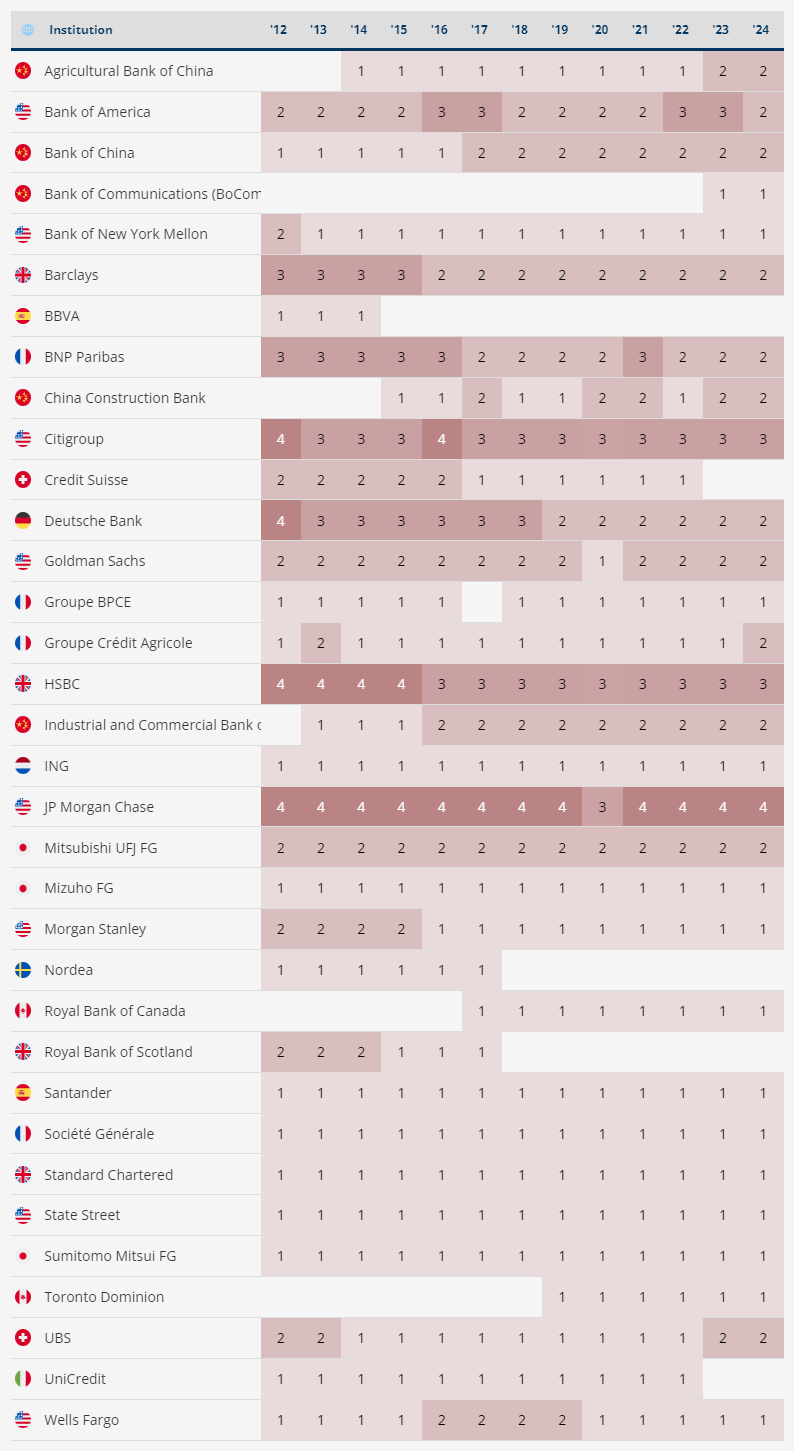

- The Financial Stability Board (FSB), in consultation with Basel Committee on Banking Supervision (BCBS) and national authorities, has identified the 2024 list of global systemically important banks (G-SIBs).1 The list uses end-2023 data,2 and is based on a methodology agreed upon in July 2018 and implemented for the first time in the end-2021 G-SIB assessment.3

- The list for 2024 includes [29] G-SIBs, the same institutions as in the 2023 list but with different allocation of the institutions to buckets (see Annex). The changes in the allocation of the institutions to buckets (see below for details) largely reflect the effects of changes in underlying activity of banks, with the complexity category being the largest contributor to score movements. The higher loss absorbency requirement established with this list will be effective beginning 1 January 2026 if there is a bucket increase.4

- FSB member authorities apply the following requirements to G-SIBs:

- Higher capital buffer: Since the November 2012 update, the G-SIBs have been allocated to buckets corresponding to higher capital buffers that they are required to hold by national authorities in accordance with international standards.5 The capital buffer requirements for the G-SIBs identified in the annual update each November will apply to them as from January fourteen months later.6 The assignment of G-SIBs to the buckets, in the list published today, therefore determines the higher capital buffer requirements that will apply to each G-SIB from 1 January 2026.

- Total Loss-Absorbing Capacity (TLAC): G-SIBs are required to meet the TLAC standard, alongside the regulatory capital requirements set out in the Basel III framework. The TLAC standard began being phased-in from 1 January 2019.7

- Resolvability: These requirements include group-wide resolution planning and regular resolvability assessments. The resolvability of each G-SIB is reviewed in the FSB Resolvability Assessment Process (RAP) by senior regulators within the firms’ Crisis Management Groups.8

- Higher supervisory expectations: These requirements include supervisory expectations for risk management functions, risk data aggregation capabilities, risk governance and internal controls.9

- The BCBS publishes the annually updated denominators used to calculate banks’ scores and the thresholds used to allocate the banks to buckets and provides the links to the public disclosures of the full sample of banks assessed, as determined by the sample criteria set out in the BCBS G-SIB framework. The BCBS also publishes the thirteen high-level indicators of the banks in the assessment sample used in the G-SIB scoring exercise for 2024.10

- A new list of G-SIBs will next be published in November 2025.

- In November 2011 the FSB published an integrated set of policy measures to address the systemic and moral hazard risks associated with systemically important financial institutions (SIFIs). In that publication, the FSB identified as global systemically important financial institutions (G-SIFIs) an initial group of G-SIBs, using a methodology developed by the BCBS. The November 2011 report noted that the group of G-SIBs would be updated annually based on new data and published by the FSB each November. ↩︎

- The majority of banks reported data as of 31 December 2023. Exceptions include four banks from Australia (of which three reported data as of 30 September 2023 and one as of 31 March 2024) and all banks from Canada (31 October 2023), India (31 March 2024) and Japan (31 March 2024). ↩︎

- See BCBS (2018), Global systemically important banks: revised assessment methodology and the higher loss absorbency requirement, July. The G-SIB assessment methodology is set out in chapter SCO40 of the Basel Framework. ↩︎

- In case of a bucket decrease, the lower level of loss absorbency required will be effective immediately, unless national authorities exert discretion to delay the release of the higher loss absorbency requirement (see RBC40.6 of the Basel Framework). ↩︎

- In some jurisdictions, G-SIBs may be required to set aside additional capital buffers under the relevant higher loss absorbency requirements for domestic systemically important banks (D-SIBs). ↩︎

- G-SIB buffers are part of the buffers in the Basel III capital framework, complementing the Basel III minimum capital requirements. The Basel III monitoring results published by the BCBS provide evidence on the aggregate capital ratios under the Basel III frameworks, as well as the additional loss absorbency requirements for G-SIBs. ↩︎

- See FSB (2015), Total Loss-Absorbing Capacity (TLAC) Principles and Term Sheet, November. The BCBS published the final standard on the regulatory capital treatment of banks’ investments in instruments that comprise TLAC for G-SIBs on 12 October 2016. In March 2017 (updated in December 2018), the BCBS published a consolidated and enhanced framework of Pillar 3 disclosure requirements, including new disclosure requirements in respect of TLAC. ↩︎

- The timeline for implementation of resolution planning requirements for newly designated G-SIBs were also set out in the FSB 2013 Update of group of global systemically important banks (G-SIBs), Annex II. ↩︎

- The timeline for G-SIBs to meet this requirement were also set out in the FSB 2013 Update, ibid. ↩︎

- See BCBS,Global systemically important banks: Assessment methodology and the additional loss absorbency requirement ↩︎