Russia’s invasion of Ukraine in February 2022 produced dislocations in several commodities markets, whose prices surged and became more volatile. The shock affected a broad range of commodities, with the price of European natural gas and industrial metals doubling, oil prices surging by more than 30% and wheat prices also rising sharply, albeit a few months later.

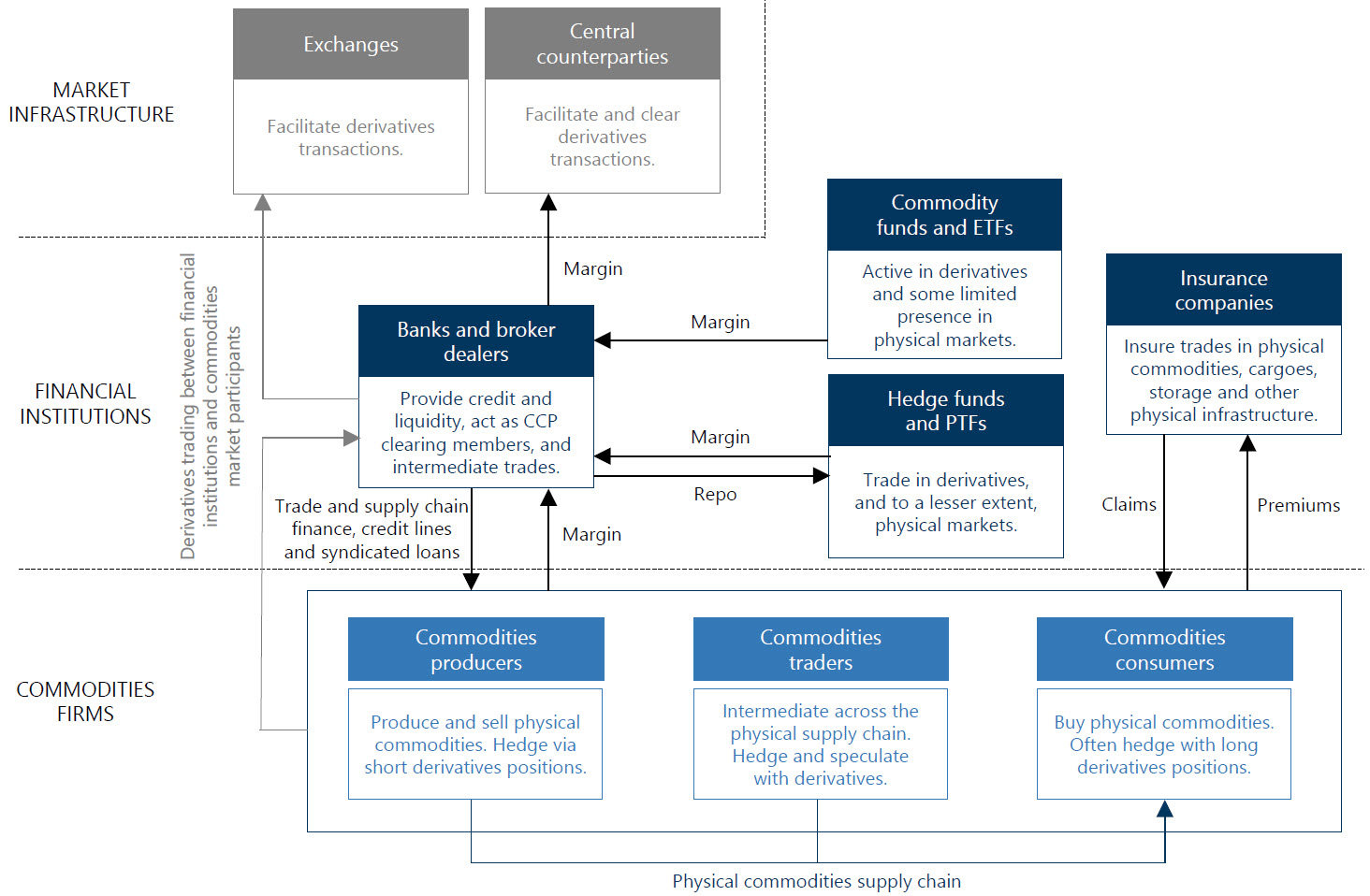

This volatility led to a spike in margin calls on commodities derivatives contracts, particularly in Europe, resulting in an increased demand for liquidity to meet those calls. The commodities ecosystem as a whole was largely able to absorb the shock. There were no major disruptions to market functioning – with the exception of the London Metal Exchange nickel market – and there was a limited impact on the rest of the financial system. However, these events exposed the complex linkages between commodities markets and the financial system that involve a varied array of commodities traders and producers, financial intermediaries and end-users.

The report presents an overview of a few globally traded commodities markets that are of particular economic importance at the current juncture (crude oil, natural gas, and wheat) and examines their vulnerabilities, focusing on the mechanisms through which any further stresses in these markets could propagate more broadly through the financial system. The report also identifies a number of data gaps that hamper the assessment of vulnerabilities and transmission channels in the commodities sector.

Stylised interlinkages in exchange-traded commodity markets

The report explains how the commodities ecosystem has adapted to the February 2022 shock and concludes with learnings and policy implications. A number of the vulnerabilities and channels of contagion discussed in this report – including leverage, impact of large margin calls on liquidity demand and market opacity – are not unique to commodities markets. Many of these issues are being addressed in the FSB’s work programme to enhance the resilience of non-bank financial intermediation.