Bail-in is at the core of resolution strategies for global systemically important banks (G-SIBs). The write-down and conversion of Minimum Total Loss-absorbing Capacity (TLAC) instruments, such as bail-in bonds, and other debt into equity helps to facilitate a creditor-financed recapitalisation. It is an important resolution tool set out in the Key Attributes to achieve an orderly resolution that minimises any impact on financial stability and ensures the continuity of critical functions, without exposing taxpayers to loss.

This paper describes some of the main operational processes and arrangements that resolution authorities of G-SIBs follow when operationalising bail-in in accordance with their jurisdictions’ legal frameworks, securities law and requirements of trading venues (TVs).

Drawing on examples and practices across different jurisdictions, this paper provides an overview of bail-in resolution approaches, including the suspension of trading and delisting from TVs of securities of bailed-in firms; the (re-)listing and (re-)admission to trading of new and existing securities as part of the bail-in process.

The paper reviews the role of central securities depositories (CSDs), which play an important role in the execution of bail-in, reflecting bail-in transactions in their books, e.g. the cancellation of shares, write-down and/or conversion of eligible instruments and issuance of new shares and interim instruments.

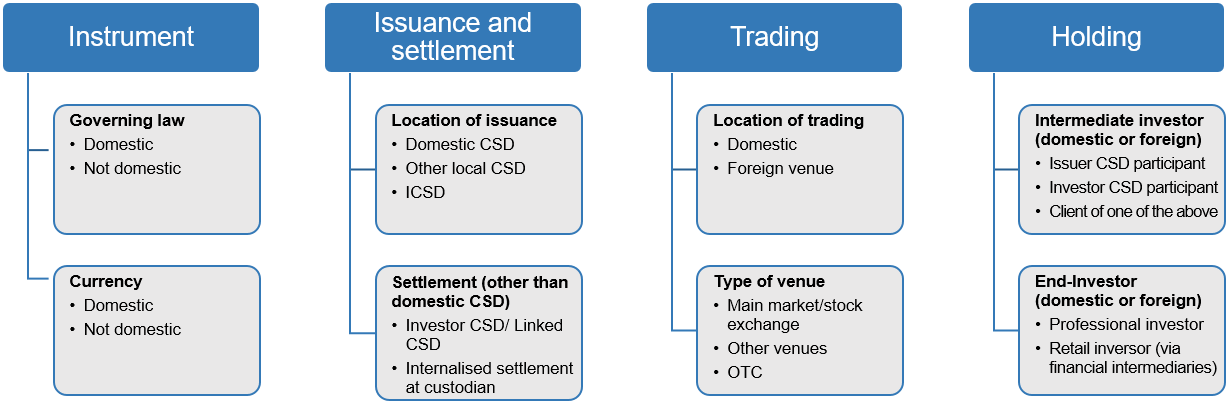

Overview of main Central Security Depository and Trading Venue considerations for bail-in execution

The paper also highlights cross-border challenges to the execution of bail-in, when securities are listed on more than one TV (dual listing or secondary listing) across different jurisdictions, or where securities are issued in a market other than the domestic market. These include the suspension of trading and settlement across all relevant TVs and CSDs; the distribution of the new securities in foreign markets/ to foreign investors; and operational challenges arising for example from the involvement of multiple CSDs. These issues introduce additional complexities to the execution of bail-in, which may need to be specifically addressed as part of resolution planning.

The FSB will continue to facilitate the sharing of practices amongst authorities and efforts to address these issues, including by continuing its engagement with stakeholders as part of the work of its Resolution Steering Group and Bank Cross-Border Crisis Management Working Group.