Summary of document history

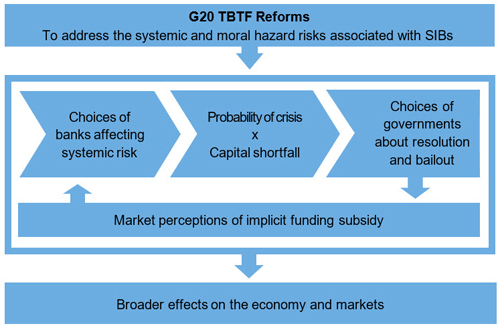

This report, for public consultation, provides an evaluation of too-big-to-fail (TBTF) reforms for systemically important banks. These reforms were endorsed by the G20 in the aftermath of the 2008 global financial crisis and have been implemented in FSB jurisdictions over the past decade. The evaluation examines the extent to which the reforms are reducing the systemic and moral hazard risks associated with systemically important banks, as well as their broader effects on the financial system.

The reforms being evaluated include: (i) standards for additional loss absorbency through capital surcharges and total loss-absorbing capacity requirements; (ii) recommendations for enhanced supervision and heightened supervisory expectations; and (iii) policies to put in place effective resolution regimes and resolution planning to improve the resolvability of banks.

In particular, the evaluation found that:

TBTF reforms have made banks more resilient and resolvable.

-

Systemically important banks are better capitalised and have built up significant loss-absorbing capacity. The capital ratios of global systemically important banks have doubled since 2011.

-

Many FSB jurisdictions have introduced comprehensive bank resolution regimes and are carrying out resolution planning. This gives authorities a wide range of options for dealing with banks in stress.

-

Evidence from market prices and credit ratings suggest that these reforms are seen as credible by market participants.

The benefits of the reforms significantly outweigh the costs.

-

Material negative side effects of the reforms have not been observed. Other market participants have stepped into areas where large banks have reduced their activities, while market fragmentation has not increased.

-

On a conservative estimate of the probability and costs of financial crisis, the reforms have produced net benefits to society.

There are still gaps that need to be addressed.

-

Resolution of banks is a complex process, and some obstacles to resolvability remain. The FSB continues its work to make sure these are addressed and to encourage full implementation of the resolution reforms.

-

Supervisors, firms and markets have much better information than before the implementation of the reforms, but reporting and disclosures could still be improved.

Overview of the building blocks of the evaluation of too-big-to-fail reforms

The evaluation, which was conducted before the onset of the COVID-19 pandemic, draws on a broad range of information sources and is based on numerous empirical analyses and extensive stakeholder feedback.

The FSB has also published a technical appendix to the evaluation, which provides the detailed empirical evidence for the conclusions reached. Estimates of the social costs and benefits of the TBTF reforms and a Resolution Reform Index were also published.

Responses to the public consultation should be sent to [email protected] by 30 September 2020 with “TBTF consultation” in the subject line. All responses will be published on the FSB website unless respondents request otherwise.