This is the fourth annual report on the implementation and effects of the G20 financial regulatory reforms. Ten years after the crisis, the report highlights the progress made in the reform agenda as the FSB pivots towards implementation and rigorous evaluation. Looking ahead, the report highlights some challenges in promoting a financial system that supports the G20’s objective of strong, sustainable and balanced growth, while preserving open and integrated markets and adapting to rapid technological change.

The report documents the substantial progress that has been made in implementing key post-crisis financial reforms; discusses how the reforms have contributed to the core of the financial system becoming more resilient to economic and financial shocks; describes the FSB’s work to evaluate whether reforms are working as intended; lays out why preserving financial stability, and supporting sustainable growth, requires the continued monitoring of developments in the global financial system; and documents the benefits of cooperation between jurisdictions in the aftermath of the crisis.

The report, which was delivered to the G20 Summit in Buenos Aires, calls for the support of G20 Leaders in implementing the agreed reforms, and reinforcing global regulatory cooperation.

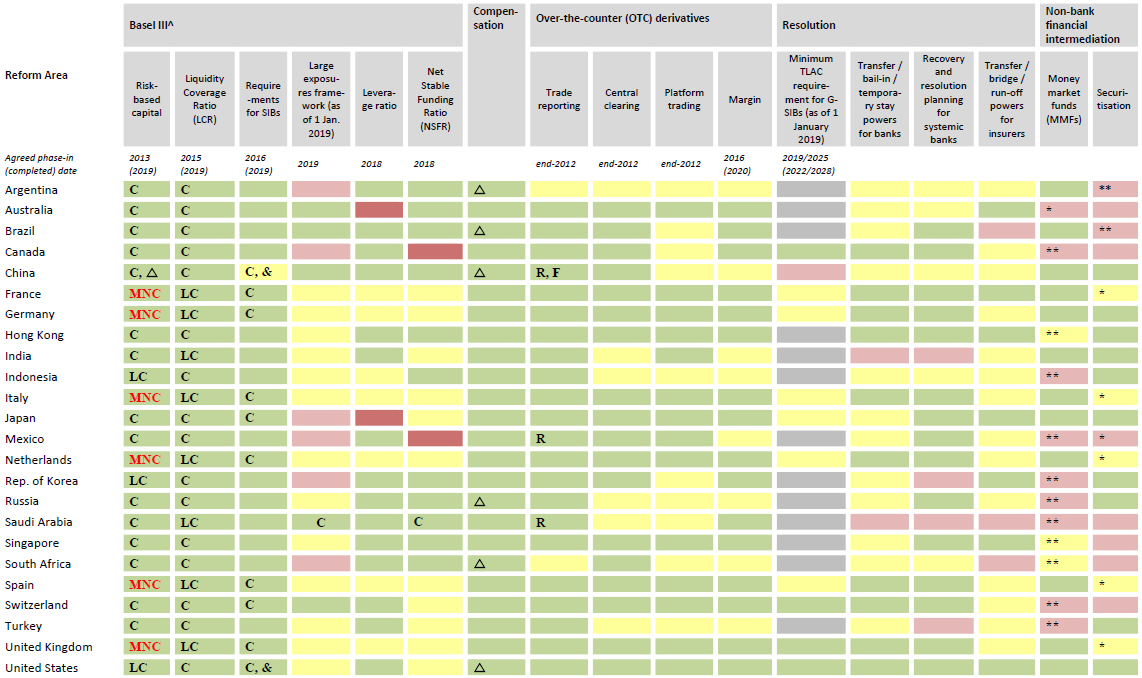

The report includes a colour-coded table that summarises the status of implementation across FSB jurisdictions for priority reform areas.

The FSB is now pivoting towards dynamic implementation of the G20 reforms and rigorous evaluations of their effects in order to support the provision of financial services to the real economy. The FSB will also continue to monitor financial stability risks relating to high sovereign, corporate and household debt levels in many parts of the world, and to assess the resilience of evolving market structures and the impact of technological innovation.